The electric company will charge the business a base (fixed) cost each month, but the amount the business is charged on top of the base depends on the amount of electricity used, making it subject to change, thus semi-variable. A common example of a semi-variable overhead cost is the cost of electricity.

A semi-variable cost is a cost that will occur no matter what, but the value will change depending on certain factors. Overhead costs don’t necessarily have to be fixed, they can also be semi-variable.

Rent is a business expense not related to labor and is ongoing regardless of business performance. An example of a common fixed overhead cost is rent. Most overhead costs are fixed costs, meaning that these expenses remain constant and do not change depending on business performance. It is also possible for overhead costs to arise even in the absence of unit volume, but to increase further when unit volumes increase these are called semi-variable overhead costs.Overhead refers to the ongoing expenses that a business must pay aside from labor or costs directly related to labor. Other overhead costs will change with unit volume, such as manufacturing supplies and the cost of electricity for a production facility these costs cannot be tied to specific units produced, but still vary with volume levels. For example, the salary of the production manager will not change even when there are significant changes in the number of units produced.

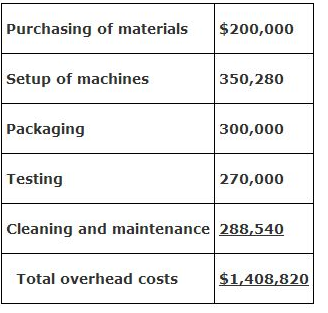

Many overhead costs are fixed in nature, which means that they do not change with the volume level. Common examples of overhead costs found in many businesses are as follows: : a stroke in a racket game made above head height : smash. especially : the ceiling of a ship's compartment. For example, the overhead costs incurred by a casino will vary dramatically from those incurred by a manufacturer of sports equipment. : business expenses (such as rent, insurance, or heating) not chargeable to a particular part of the work or product. The exact types of overhead costs incurred will vary by business. A quarterly review of overhead costs is recommended, to ensure that these costs do not get out of hand. Or, a firm invests in an expensive copier machine, despite experiencing relatively low photocopying volumes. For example, a business might have rented too much office space, and should sub-lease it whenever the activity level of the business declines. There tends to be a lower level of oversight for overhead costs, so they can linger within a business, even when they are no longer needed. It is essential for management to monitor overhead costs at all times, since they can bleed off profits. Thus, the cost of the manufacturing supervisor, materials handling staff, and facility rent are all classified as overhead costs, while the costs of direct materials are not overhead costs. Overhead Costs represent the ongoing, indirect expenses incurred by a business as part of its day-to-day operations. Overhead costs are any operational expenses stated in a company’s income statement that are not directly associated with the cost of goods or services. They must be incurred in order to stay in business, irrespective of the sales level of the organization. Although they are related, the overhead cost meaning. Overhead costs are any expenditures not directly associated with the creation of a product or service. Things like business insurance, administrative costs, rent, and utilities are all overhead cost examples.

0 kommentar(er)

0 kommentar(er)